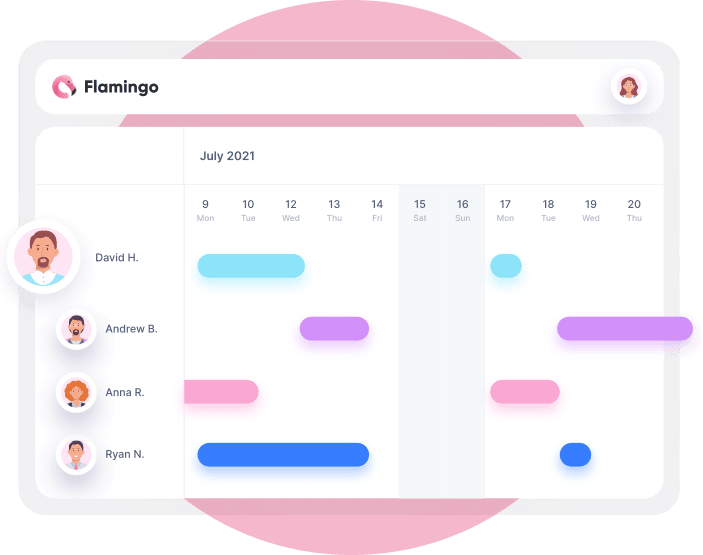

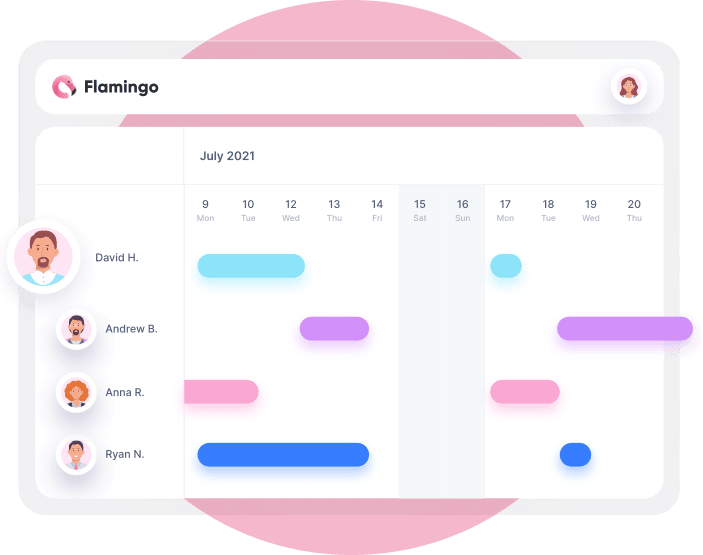

Flamingo is a leave management solution built for modern teams.

No more cluttered spreadsheets and manual data entry. Manage your entire team's leave, directly from Slack, and speed up your leave management workflow.

Learn moreDo you operate in the United Kingdom, or have employees based in the UK? If so, check out the UK leave laws you need to take into account, related to public holidays, annual leave, sick leave, parental leave and more.

This page is intended for reference purposes only and does not constitute legal advice. Please see official government sources or consult a legal professional for actual legal advice.

Public holidays in the United Kingdom are known as “bank holidays”. Some of the observed bank holidays differ between England and Wales, Scotland and Northern Ireland, with others consistent across each country.

Employers don’t need to offer holiday pay for bank holidays. They can, however, include bank holidays as part of your statutory annual leave entitlement – in which case the employee will be paid for the bank holiday out of their annual leave.

There is also no requirement for employers to pay above the usual rate of pay for employees working on a bank holiday.

If a bank holiday happens to fall on a weekend (Saturday/Sunday), it will be substituted for the next working day.

Here are the official bank holidays in England and Wales, Scotland and Northern Ireland for 2024:

| Date | Holiday |

|---|---|

| January 1 | New Year’s Day |

| March 29 | Good Friday |

| April 1 | Easter Monday |

| May 6 | Early May bank holiday |

| May 27 | Spring bank holiday |

| August 26 | Summer bank holiday |

| December 25 | Christmas Day |

| December 26 | Boxing Day |

| Date | Holiday |

|---|---|

| January 1 | New Year’s Day |

| January 2 | 2nd January |

| March 29 | Good Friday |

| May 6 | Early May bank holiday |

| May 27 | Spring bank holiday |

| August 5 | Summer bank holiday |

| December 2 | St Andrew’s Day (substitute day) |

| December 25 | Christmas Day |

| December 26 | Boxing Day |

| Date | Holiday |

|---|---|

| January 1 | New Year’s Day |

| March 18 | St Patrick’s Day (substitute day) |

| March 29 | Good Friday |

| April 1 | Easter Monday |

| May 6 | Early May bank holiday |

| May 27 | Spring bank holiday |

| July 12 | Battle of the Boyne (Orangemen’s Day) |

| August 26 | Summer bank holiday |

| December 25 | Christmas Day |

| December 26 | Boxing Day |

Workers in the UK are entitled to 5.6 weeks of paid annual leave (aka paid holiday or statutory leave in the UK).

For employees working a regular 5 day week, this amounts to a 28 days of paid holiday each year. For part-time employees, the number will be less – equal to 5.6 x their regular number of working days per week.

Statutory leave entitlement is limited to 28 days, meaning if someone works more than 5 days per week, they will only be entitled to 28 days or paid holiday by law.

An employer may offer more than this, but is not required to by law.

Statutory leave entitlement covers almost all workers in the UK, including those with irregular hours or workers on zero-hour contracts.

You can use the UK government holiday calculator to figure out the minimum holiday entitlement for part time employees or pro rata entitlement for someone who started part of the way through the year.

Annual leave begins to accrue for the employee as soon as they begin working. They will gradually earn leave over the course of the year, adding up to 5.6 weeks’ worth of working days by the end of the employment year.

Workers can only carry over a certain amount of leave into the next working year, making the majority of UK leave policies “use it or lose it” policies.

If workers have 28 days’ statutory leave entitlement, they are only entitled to carry over 8 days into the next year. The rest must be taken within the year it’s earned, or it will be lost.

The exact number of days that can be carried over depends on the worker’s employment contract.

Workers should be paid their regular rate of pay when taking annual leave.

Employees cannot cash out their annual leave (meaning to take a cash payment instead of actually taking time off). The only situation where someone can receive their annual leave as cash is upon termination of employment.

Eligible employees can receive up to 28 weeks paid sick leave, of £99.35 per week. This is known as Statutory Sick Pay (SSP).

The eligibility requirements are:

If the employee is sick for 7 or more days, they will need to provide a fit note (aka a sick note) from a healthcare professional.

Employees can start receiving SSP from the fourth day that they’re off work sick. Before this, any sick leave is unpaid.

Workers can take up to 52 weeks’ maternity leave, assuming they meet the eligibility criteria. This includes 26 weeks of ordinary maternity leave, and 26 weeks of additional maternity leave.

To receive Statutory Maternity Pay (SMP), the mother will have to earn an average of at least £123 a week, and be employed by the company on or before the 15th week before expected delivery date.

SMP can be paid for up to 39 weeks, and entitles the employee to:

Learn more about Statutory Maternity Pay, eligibility requirements, and more, at Gov.uk.

Eligible parents can receive 1 or 2 weeks of paid paternity leave, taken in one go, after the birth. Paternity leave must be taken (and end within) 56 days of the birth.

Paternity pay is £156.66, or 90% of the employee’s average weekly earnings (whichever is lower).

Employees may also be eligible for Shared Parental Leave, which can be split between the mother and their partner.

Parents can also be eligible for Adoption Leave and Pay when adopting a child. This entitles one parent to up to 52 weeks of leave, with up to 39 weeks of Statutory Adoption Pay (the same rate as Maternity Leave).

Only one parent in a couple can take Adoption Leave – the other may be able to take Paternity Leave, however.

Employees are entitled to time off from work for emergencies involving a dependant – such as a spouse, child, grandchild, parent or grandparent who depends on the employee for care.

Compassionate leave or time off for family and dependants is not required to be paid, however employers may provide paid leave if they wish.

Learn more at Gov.uk.

There is no legal requirement to bereavement leave in the UK (leave for when there is a death of an immediate family member).

This would come under compassionate leave, and is up to the discretion of the company whether it’s granted or not, and whether or not it’s paid.

Employees can take time off for certain public duties, which is not required by law to be paid. Employees must be allowed to take time off for jury duty – again, this is not paid, but the employee can claim from the government some expenses and up to £64.95 per day once their jury service is completed.

A Guide to Employment Status in the UK

UK Holiday Entitlement Calculator

SSP (Statutory Sick Pay) Eligibility & Other Requirements

This page is intended for reference purposes only and does not constitute legal advice. Please see official government sources or consult a legal professional for actual legal advice.

No more cluttered spreadsheets and manual data entry. Manage your entire team's leave, directly from Slack, and speed up your leave management workflow.

Learn more